Evaluating the size of the market is a vital step for every startup. If the market is not big enough, it’s impossible to make a high return neither for an investor nor for an entrepreneur no matter the product. So when it comes to market size forecasting, the right choice of an estimating model can change everything. In this guide, we’ll break down the difference between the three main methods of financial forecasting – bottom-up, top-down, and value theory market analysis.

How can you figure out your market size? What are the methods of market sizing? What differences do they have? What are their pros and cons? Finally, which method to choose for your startup? Keep reading and you’ll fill in those knowledge gaps.

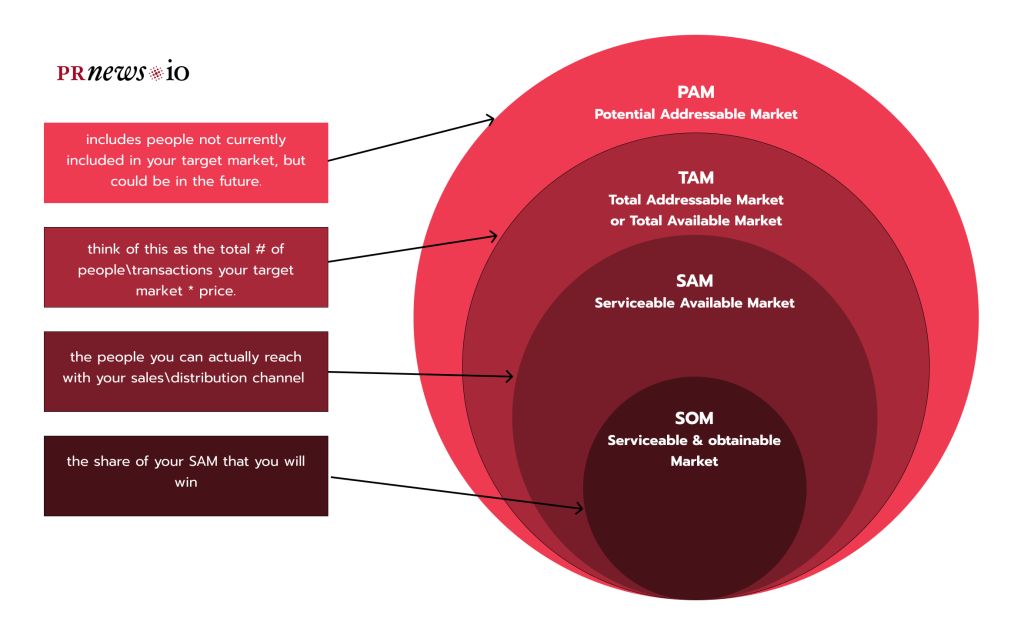

Note: these methods are approaches to calculate the important metrics TAM, SAM, and SOM. Check out our article so that you have a full understanding of the market size calculation.

Top-down Market Sizing Definition

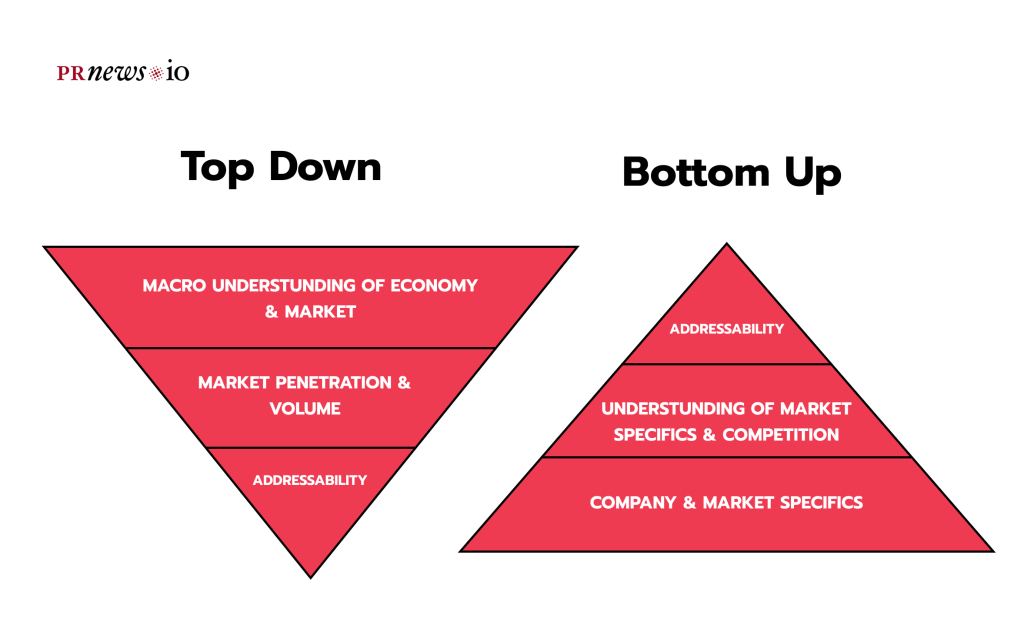

As the name indicates, the top-down view creates a macro analysis of the market. This way, you can find the largest possible income perspective that attracts investors.

All you have to do is to take already existing estimates from analysts like Forrester, IDC, or G2 and then try to predict the proportion of the market that your business will capture.

How Top-down Market Sizing Works?

This approach does not require any historical data of the company as it is focused on the market externally.

A common process is as follows:

- Tentatively identify the markets in which you can participate.

- Find the research reports on your market (industry) from such analysts as Gartner or Forrester.

- Pull the data of the total market size from them.

- Sometimes: You may narrow the market size down if you need to.

The formula of the top-down approach is very easy:

Total market size x Price of the product = Market Size

Top-down Market Sizing Example

As an example, let’s take an IT start-up that offers a financial app targeting small businesses that cannot afford expensive financial software and find TAM, SAM, and SOM:

TAM: The startup relies on industry research that shows that there are one billion businesses around the world, out of which 30% lack access to such premium financial software:

30% x 1,000,000,000 customers = 30,000,000 potential customers

So if the business is offering the application with annual subscriptions of $100, the estimated market size is $3B:

30,000,000 x $100 = $3B – market size

SAM: TAM metric is promising, but not realistic. So we can narrow this number down, applying geographical limits in which the app will be marketed.

Let’s imagine the owners want to start serving only with American companies. Thus, they need to find another report to find out the number of small businesses — 9,000,000 potential customers:

9,000,000 x $100 = $9ooM – market size

Finally, for SOM: let’s be more realistic, remind ourselves about competitors and current resources, and narrow down SAM. Let’s say, that after conducting another research they found out that competitors can’t capture 25% of the market:

9,000,000 x 25% = 2,250,000 potential customers

2,250,000 x $100 = $225M – market size

What Is Bottom-up Market Sizing?

While top-down market estimation is usually easy to do, the results can be misleading. Can you really reach that entire market even limited to some features? The good news is that bottom-up market sizing gives us a more accurate picture of those factors.

As the name implies, this estimation attempt is the complete reverse process from what we just looked at.

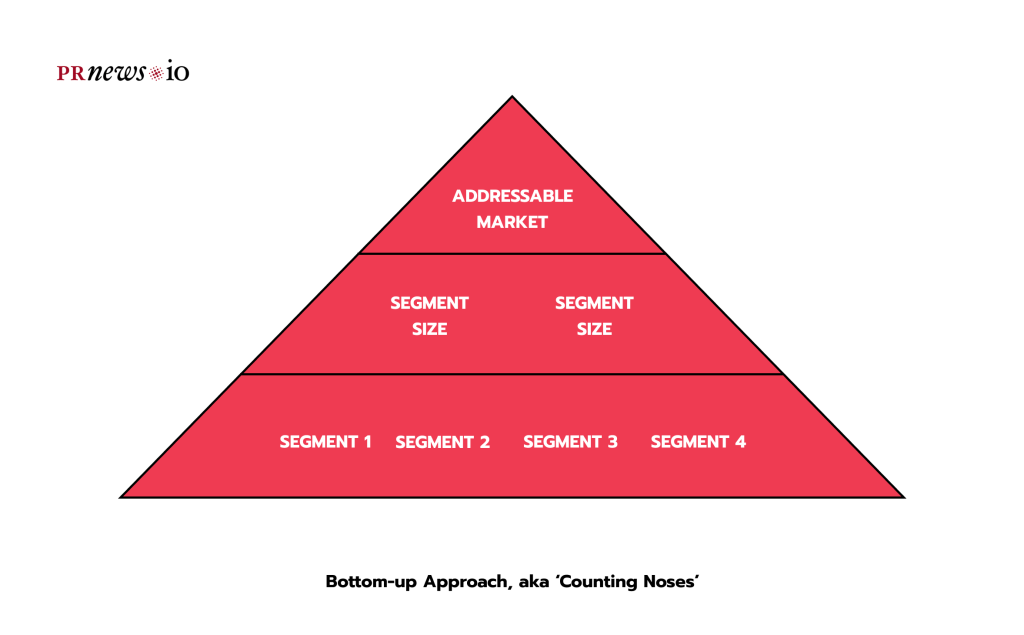

A bottoms-up analysis is a proving the market customer by customer — define your product’s price, estimate the number of your prospects, and do the math. It is less concerned with the market at large. You concentrate on the business itself and the product you want to offer.

How to Use Bottom-up Market Sizing?

To do the bottom-up market analysis you start with the basic units of your business (your product, price, customers) and estimate how far you can scale up those units. A bottom-up market size calculation will take into account:

- How much have people paid (or are willing to pay) for a similar product or service?

- What are your potential target market segments?

- What are the distribution channels and where are the limitations?

Market sizing with a bottom-up approach consists of determining the price of your product and finding the number of potential audiences. You can find out what your company can achieve in sales in three steps:

Step 1: Determine the product price

This step depends on the type of your startup – a startup idea or an existing business.

If your startup is new, your price decision should be based on industry benchmarking: how much people can spend on your product, how much they spend for a similar product from your competitors, etc.

If you want to attract investments for the existing business, you can start from the company’s data you already have. Your estimations should be driven based on historical insights: revenue, expenses, number of current clients, etc.

Step 2: Estimate the size of the prospects

Do some research and find out the number of reachable prospects. Consider these questions:

- Who is your specific client?

- How many of them are in the market?

- What part of them can you realistically reach?

- What price are they ready to spend for your product?

- And the most important: How many or how often will they buy from you?

Step 3: Apply the next formula

Bottom-up market sizing has a very simple formula:

Price of the product x Number of potential customers = Market Size

Bottom-up Market Sizing Example

Let’s continue with the same startup company with an accounting mobile app and annual subscriptions worth $100.

TAM: Based on the effectiveness of the ads and the number of sales reps, their head of marketing calculated that realistically they could reach about 500,000 companies that theoretically need their app. That brings it to $50M:

500,000 x $100 = $50M – market size

SAM: Let’s take the less lucrative but more reasonable estimation of the number of businesses in its target market to get the market size.

Let’s take the benchmark of the industry: e.g., only 30% of the companies are ready to change their current software:

500,000 x 30% = 150,000 potential customers

150,000 x $100 = $15M – market size

SOM: let’s be even more realistic. Probably, our software doesn’t fit all the target companies we plan. Let’s say, we can satisfy the needs of 70% of potential customers:

150,000 x 70% = 105,000 potential customers

105,000 x $100 = $10.5M – market size

What is Value Theory Market Sizing?

While the other two approaches use the existing data, value theory is more abstract. We use this method when estimating the value of a new product or product improvement that is new for the market.

With value theory, marketers must evaluate how much a customer would pay for a new or improved product. Such a task had owners of streaming subscription services, like Spotify, when they were preparing to roll it out.

How to Use Value Theory Market Sizing?

Not having any market data for this product (yet), value theory calculations of market size are calculated as the assumed price of your product multiplied by the total number of potential customers.

Here are some questions to consider when calculating the total available market with the Value Theory method:

- How many people would get value out of your product?

- How much money people would like to pay for it?

Value Theory Market Sizing Example

Let’s consider the product that doesn’t exist in the market yet: the blood test to detect all genetic diseases which you can do at home.

TAM: Based on the survey you did people are ready to pay $1.000 for such a test. You may assume that all US adults (approximately 258M) would like to buy it:

258,000,000 x $1.000 = $258B – market size

SAM: Let’s take the less lucrative but more reasonable estimation: US residents of the age of 18-45 (approximately 100M).

100,000,000 x $1.000 = $100B – market size

SOM: let’s be even more realistic. Probably, not all of them can afford this price, so let’s narrow down this segment with the income they get. Let’s assume that only 40% of the previous target group can buy it without a big influence on their personal budget:

100,000,000 x 40% = 40,000,000 potential customers

40,000,000 x $1,000 = $40B – market size

Top-down vs Bottom-up vs Value Theory Market Sizing – Which One Is the Best for a Startup?

All approaches have their place. That’s why they’re still leading methods in financial modeling. Understanding the advantages and disadvantages of all approaches and when to use each one is key to the startup’s market sizing.

Pros and Cons of Top-down Market Sizing

In the early stages, a top-down approach may be more suitable due to limited resources. As the startup matures and more data becomes available, a shift towards a bottom-up or value-based approach may be warranted.

Check out the list of the pros and cons of the top-down approach below:

Pros:

- It’s quick and easy

That’s because startups don’t need to dive deeply into every single part of their activities to calculate the market sizing. All you need is to use insights from a credible analytical report.

- It’s optimistic

Gives insight into what is possible in the market, that’s why in most cases it gives an optimistic number of the market size.

- It is good for established markets

It tends to work well for big markets, where there is already lots of data and existing analysis.

Cons:

- The wrong perception

The top-down method makes the founder just copy the market data from the analytical reports. Since you didn’t conduct this analysis yourself, you can’t prove or explain the number in the market size estimation.

- Inaccuracy

It is based on the guessings rather than on proven data. While optimistic forecasting may raise investors’ interest, they’ll want to see a credible operational plan for achieving it.

- Too generic

This might not always be correctly reflected in your sales expectations if you simply take an X percentage of a market.

- Not appropriate for new markets and disruptive products

Top-down approaches often don’t mean that a startup can change the actual size of the market size.

Pros and Cons of Bottom-up Market Sizing

While a top-down market size calculation can give you a quick overview of a market, you’ll need further granulation to make strategic decisions based on many factors that affect your market and product.

There are several reasons why businesses should consider applying a bottom-up approach.

Pros:

- Accuracy

It tends to result in better forecasting and more accurate data on a more granular level, helping you better understand how a particular factor will affect the whole.

- Availability for new markets

It’s especially appropriate for new markets and markets where your product is likely to produce a breakthrough impact.

- Identification of the most potential products or services

Provides a more granular and detailed view. It can give you an understanding of the most profitable products. These insights assist you in making better marketing decisions for your business.

The bottom-up forecasting model has its benefits, but it’s useful to consider its several disadvantages.

Cons:

- Time

It can take more time and involve more resources than a top-down approach because a bottom-up approach requires a much more in-depth analysis of your startup.

- Needs more accuracy

Relies heavily on the availability of accurate information about the target market. Any mistakes you make early on at the micro-level become compounded as you work up to the macro level. It’s crucial to ensure you’re doing everything right, or these mistakes and misunderstandings will accomplish your entire analysis.

Pros and Cons of Value Theory Market Sizing

Value market sizing combines elements of both top-down and bottom-up approaches. It starts with a top-down estimate of the total market value and then applies a conversion rate to estimate the number of potential customers. This approach is a good compromise between accuracy and speed, making it a suitable choice for many startups.

Pros:

- Uniqueness of the product

Value theory is helpful for businesses that have developed a unique product that is creating new products or improving current ones.

- Doesn’t need any marketing insights

It’s a suitable method for startups that don’t have any benchmarks or don’t have the resources to conduct their own surveys or research.

Cons:

- No accuracy in conclusions

Value theory is based on supposition and guesswork. Its results will never be 100% accurate.

Summary

So, which should you use: top-down, bottom-up, or value theory? Depends on your business idea.

Market sizing is a crucial aspect of business planning, and the choice between top-down, bottom-up, or value-based market sizing depends on various factors, including the nature of the startup, available data, and the level of precision required.

Is your business in need of a PR makeover?

- Benefit from media coverage assistance.

- Witness a refined branding approach.

- Watch as your recognition soars.